lake county real estate taxes ohio

Only districts with levies are listed. The property tax rate in Lake County Ohio is 25.

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Your real estate tax.

. Type the parcel ID into the search box above. 105 Main Street Painesville OH 44077 1-800-899-5253. Lake County collects on average 154 of a propertys assessed fair.

Skip to Sidebar Nav. School districts get the. You may search by Parcel ID street address or other.

Ways to Pay Your Stark County Real Estate Tax Bill pdf If paying after the due date a Penalty will be assessed pdf STARK COUNTY TREASURER. All estimates are for the May 2022 election. The median property tax also known as real estate tax in Lake County is 243300 per year based on a median home value of 15810000 and a median effective property tax rate of.

Search by Owner name. 105 Main Street Painesville OH 44077 1-800-899-5253. 105 Main Street Painesville OH 44077 1-800-899-5253.

Lake County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Lake County Ohio. Property 1 days ago Lake County Ohio. 105 Main Street Painesville OH 44077 1-800-899-5253.

105 Main Street Painesville OH 44077 1-800-899-5253. Find 1047 homes for sale in Lake County with a median listing home price of 210000. Search by parcel number.

The median property tax in Lake County Ohio is 2433 per year for a home worth the median value of 158100. Type in full name or part of the name into the. Home Departments Treasurer.

Assist the public in obtaining tax maps and survey information for property in Lake County. Skip to Page Content. Browse Lake County OH real estate.

The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. This site provides property records in Lake County IL for the Assessment and Tax Offices. To Property records Search.

Pay Real Estate Tax Online. Use the to find a group of parcels. Skip to Sidebar Nav.

While taxpayers pay their property taxes to the Lake County Treasurer Lake County government only receives about seven percent of the average tax bill payment. Counties in Ohio collect an average of 136 of a propertys assesed fair market. Home Departments Treasurer.

The tax is used to fund county services such as schools roads. Any changes to the tax roll name address location assessed value must be processed through the Lake County Property Appraisers Office 352 253-2150. Skip to Sidebar Nav.

The tax is levied on the value of all real estate in the county. Home Departments Auditor Real Estate Tax Rates and Special Assessments.

Property Taxes By County Interactive Map Tax Foundation

:max_bytes(150000):strip_icc()/Sheriffs-Sale-Kirby-Hamilton-E-Getty-Images-56a580a33df78cf772889e4f.jpg)

The Basics Of A Sheriff S Sale Or Foreclosure Auction

Compare Property Tax Rates In Greater Cleveland And Akron Many Of Highest Rates Statewide In Cuyahoga County Cleveland Com

Real Estate Geauga County Auditor S Office

Cleveland Appraiser Cuyahoga Lorain Medina Lake Counties

Lake County Ohio Basic Property Search Search

1 4 Acres Of Residential Land For Sale In Madison Ohio Landsearch

Tracking Homestead Exemptions The New York Times

State Of Ohio Property Taxes How Does Lake County Stack Up Lobbyists For Citizens

Frequently Asked Questions Lake County Recorder S Office

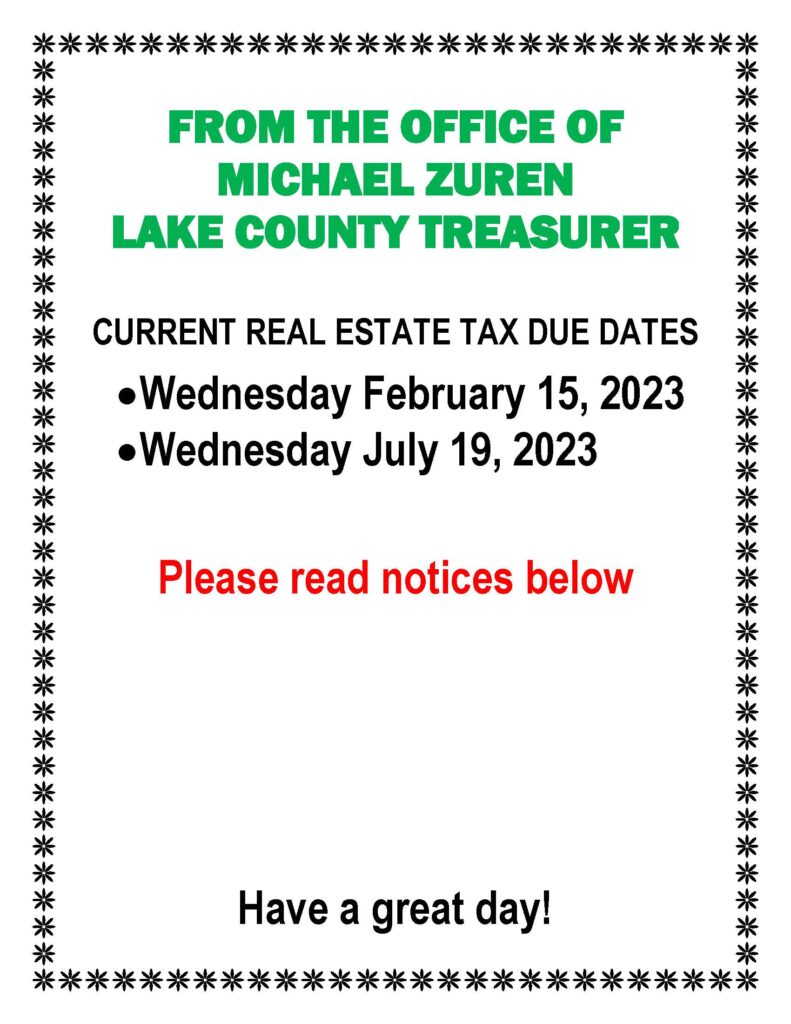

Payment Methods And Locations Treasurer

Indiana Property Tax Calculator Smartasset